Newsletter 2023-2024 Volume 10

In this edition…

- Monthly Closing Deadlines

- PantherSoft Travel Enhancements

- Travel News and Updates

- Pcard Reconciliation Reminder: Travel Purchases

- Accounts Payable Updates

- Coming to Contracts in TCM (now called Contract+)

- New Supplier On-boarding W-9 Form

- Open Encumbrance

- Coming Soon – TCM and Sourcing Access Request Moving to PeopleSoft

- FIU Panther Tech Reminder

- Month End Closing Reminder

- Year End Closing Reminders

- Florida Sales Tax Rate Decreased to 2.0%

- Reminders and Deadlines

News

Monthly Closing Deadlines

The March 2024 period in the general ledger has closed. The current and future month-end processing deadline schedules are located at Monthly Closing Deadlines.

PantherSoft Travel Enhancements

We are excited to announce enhancements that were recently applied to the Travel Compliance Center that will help travelers and their proxies more efficiently enter and manage their Travel Authorizations (TAs) and Expense/Post Travel Compliance Reports (ERs).

Enhancements you will see include:

NEW SpeedChart Functionality on Travel Authorizations

Following the enablement of the SpeedChart Key field on Expense/Post Travel Compliance Reports, many of you requested the same functionality on Travel Authorizations. The functionality is now available for TAs in both the Accounting Defaults in the header (affecting both new and existing expense lines) as well as the Accounting Details for individual expense lines. The SpeedChart Key field is in the Show All tab.

Any changes to accounting values, using the SpeedChart Key, can only be made to expense lines where the Payment Type is set to Out of Pocket or Travel & Entertainment Card.

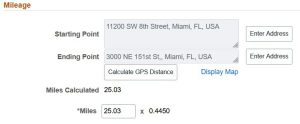

NEW GPS Mileage Calculator for Expense/Post Travel Compliance Reports

The GPS Mileage Calculator for Expense/Post Travel Compliance Reports with or without a Travel Authorization is now fully functional. For reports attached to a Travel Authorization, the mileage will carryover from the TA, however it can be modified by updating the Starting/Ending Point and clicking on the Calculate GPS Distance button.

For Expense/Post Travel Compliance Reports without a Travel Authorization, you have the option to enter the Starting and Ending Point addresses and click on the Calculate GPS Distance for the system to calculate the mileage.

Export Control can now Deny Foreign Travel Authorizations, Prevents Deletion

The Export Control review team now has the access to deny Foreign Travel Authorizations as necessary and will be required to enter a reason for denying the TA in the comment field. The status of these TAs will be shown as Denied and the reason for the denial will appear in the Approval History section of the Travel Authorization page.

In addition to this change, only the Travel Authorizations and Expense Reports in Pending status can be deleted.

Travel News and Updates

Travel & Other Expenses Manual:

We have updated our Travel Manual and encourage you to review the entire document, as there have been many changes. We have also updated our Travel Website and created various new forms to help you with the reconciliation of travel expenses.

Guidelines for Writing a Clear Business Purpose:

FIU requires a clear and descriptive business purpose, which is defined as one that supports or advances the university’s goals, objectives, and mission and adequately describes the expense as necessary, reasonable, and appropriate. The Business Purpose should justify the expense and be written so that someone reading it in the future would have sufficient information about the activity (for example, provide context, spell out any acronyms, include full titles and department names) and why it was a permissible FIU expense.

Defining an Appropriate Business Purpose, the 5 “W’s” (why, who, what, when, and where), and how can help you determine what information to enter in the business purpose field on a Travel Authorization and Expense report. Also, if there are specific restrictions on a funding source, it is recommended that preparers include information about the allowability of the expense in the business purpose section.

Why – The travel authorization and expense report must explain why the expense was incurred. The business purpose should substantiate why the expenses are reasonable and appropriate for the university. The “why” should include the primary reason for the expense. Who –the name of the individual who actually incurred the expense should be listed for reporting purposes. For example, if a P-Card holder booked a hotel on behalf of a visiting lecturer, the name of the visiting lecturer should be included in the business purpose field: What – The university needs to know what type of event or activity occurred or what was purchased. Include this information in the benefits section. When – The business purpose should include information about when an event occurred and dates. Where – The business purpose should include where the expense will be incurred for the business activity. How- How does FIU benefit from your attendance at the conference, convention, workshop, seminar, symposium, competition, fieldwork, meeting, summit, training, recruiting, research, etc.?

Pcard Reconciliation Reminder: Travel Purchases

When reconciling travel purchases in the PantherSoft system, it is required that the travel authorization number (TA#) and traveler name be notated in the long description/comment field.

Accounts Payable Updates

New – Vouchers Pending Receipt List

A list of vouchers pending receipt is now available on the Office of the Controller’s website. The list is updated on a weekly basis. It can be found under the News & Announcements section.

Please:

- Review the list of vouchers.

- If the items have been received or services rendered, create a receipt in PeopleSoft.

- If a receipt was created before the date noted on the spreadsheet, contact bblancog@fiu.edu or ldelcam@fiu.edu

- If an item ordered is not delivered or received, you must contact the vendor and request a credit memo.

Receiving Notifications

If you receive an e-mail from fin-panthersoft@fiu.edu requesting a receiving transaction, Accounts Payable has already received and entered the invoice. Do not resubmit the invoice. The e-mail is a notification that an invoice has been received and that there is no receipt in the system to match it. Once you create a receipt, PeopleSoft will automatically match the invoice to the receipt.

If you create a receipt and continue to receive the notifications, please send Beatriz Blanco-Hernandez (bblancog@fiu.edu) an e-mail and she will review the voucher and correct any matching errors or let you know if anything additional is needed.

ODP and Amazon

When an item ordered and invoiced is not received or is returned, a credit memo from the vendor is required to delete the invoice from PeopleSoft. Please make sure to contact the vendor and request a credit memo. The vendor will then forward it to Accounts Payable.

Amazon

Receipts should be created by shipment received and not by the total ordered amount. Most vendors issue invoices by shipment. Creating one receipt per order will delay the payment of the invoice.

Travel Reimbursements

All travel reimbursements require an approved TA. This includes any travel reimbursements that are included on a vendor invoice submitted to Accounts Payable.

Coming to Contracts in TCM (now called Contract+)

We are excited to announce that on 04/08/2024, the revamped IT Questionnaire in TCM (now called Contract+) will go live. It has been a joint effort between DoIT, The Office of the General Counsel, the PCI Compliance team and Procurement Services.

The revamped IT Questionnaire will now include the review of software (including on-prem, cloud-based tools, SAAS, etc.) by the Technology Evaluation Group (TEG) along with updates to some of the questions including those dealing with PCI Compliance.

We recognize the importance of integrating the TEG process as part of the Information Technology section of our TCM questionnaire process. This update aims to enhance our assessment procedures and ensure a more comprehensive understanding of our IT purchases.

Please note that the update will appear in new contracts only created on or after 04/08/2024. Any contracts in Draft or Pending Approval statuses prior to 04/08/2024 will still have the old version of the IT Questionnaire.

New Supplier On-boarding W-9 form

The IRS has updated the W-9 form that is required for the Supplier registration process, the latest version is March 2024. If you give instructions to potential new suppliers, please update your information using this revised form found at https://www.irs.gov/pub/irs-pdf/fw9.pdf

Open Encumbrance

Departments are encouraged to begin reviewing all outstanding POs, including blanket orders. Communicate to Herve-Serge Menyonga, Assistant Director of Procurement Systems, those purchase orders that you wish to close prior to June 30, 2024. Send your requests to close POs via email only to hmeny001@fiu.edu no later than June 21, 2024 to allow sufficient time for processing. Also, carbon copy Kesha Shrestha at keshrest@fiu.edu in your request. Please note: All invoices should be matched and approved prior to requesting that the PO(s) be closed out.

Coming Soon – TCM and Sourcing Access Request Moving to PeopleSoft

The TCM and Sourcing Access Request form, which is currently hosted in ImageNow, will move to PeopleSoft and be integrated to its Access Request System in the coming weeks. This will streamline the access request process while strengthening the oversight of these role requests.

FIU Panther TECH Reminder

Looking for Apple devices for your department needs? As your Apple Authorized Campus Store, FIU Panther TECH, located conveniently on the MMC campus, is your one-stop shop for Apple products at education prices. They offer all Apple Mac, iPad, Apple Watch and Accessories, many of them in stock for immediate pickup, including the ability to order custom configured Apple Macs. They will also automatically enroll your devices in Apple School Manager for easy device management with JAMF. Just send them your request by email at panthertech@fiu.edu, call at 305-FIU-TECH (305-348-8324) or stop by to demo the latest Apple devices in person.

Month End Closing Reminder

We want to emphasize the need for budget exceptions to be cleared in a timely manner, especially during our month-end closing process. Review the Month End Processing Deadlines for the date that references “All journals are posted” as the date that all budgets exceptions should be cleared by.

Year End Closing Reminders

The Office of the Controller is preparing the year end memo to provide guidance and deadlines that are essential for efficient closing of the fiscal year. We will be sending a separate communication in April to the key stakeholders once the memo is finalized.

In addition, we will be providing our annual in person year end closing workshop in late May so please be on the lookout for any communications related to the workshop as you will be able to register and receive continuing education credit.

We want to emphasize that now is a great time for all those departments that have activity numbers in Fund 604 Transfers from Component Units and Funds 471/472 Scholarships, to send in any reimbursement requests to their respective Direct Support Organization (DSO) to make sure you receive your reimbursements before fiscal year end.

The last date for FY2024 for departments to request deactivation or chartfield changes will be May 17th with the expectation that they will be completed before June 30th.

Florida Sales Tax Rate Decreased to 2.0%

Florida Sales Tax Rate Decreased to 2.0% effective June 1, 2024, for Rental, Lease, or License to Use Real Property

Currently, Florida imposes a 6% sales tax on the sales of most goods and certain services. In addition, Florida counties can impose a local option surtax on top of the 6% rate that varies by county. Therefore, the sales tax rate is 7% in Miami-Dade County, Broward County, and Pinellas County (due to the additional 1% surtax).

The sales tax is also imposed on commercial leases and licenses to use real property, but at a reduced rate. Some examples of real property rentals that are subject to tax include (commercial office or retail space, conference rooms, ballrooms, stadiums, arenas, etc.). The sales tax rate imposed under Florida Statutes on the rent charged for renting, leasing, or granting a license to use real property is currently 5.5% (4.5% plus the additional 1% surtax).

Effective June 1, 2024, the sales tax rate imposed under Florida Statutes on the rent charged for renting, leasing, or granting a license to use real property is decreased to 2.0%. Therefore, the combined sales tax rate for any rental activity taking place on or after June 1, 2024, will be 3.0% (2.0% plus the additional 1% surtax) for Miami-Dade County, Broward County, and Pinellas County.

To accurately collect and remit the sales tax collected by the University, rental related sales tax collections should only be posted to one of the following general ledger accounts shown below.

Account number 311318 (Sales Tax Liab MD Prop Rental) – this account is used to record/deposit sales tax for rental activity taking place in Miami-Dade County, which is subject to the reduced 3.0% (June 1, 2024) sales tax rate and the previous 5.5% (December 1, 2023) sales tax rate.

Account number 311319 (Sales Tax Liab Bwd Prop Rental) – this account is used to record/deposit sales tax for rental activity taking place in Broward County, which is subject to the reduced 3.0% (June 1, 2024) sales tax rate and the previous 5.5% (December 1, 2023) sales tax rate.

Account number 311320 (Sales Tax Liab PIN Prop Rental) – this account is used to record/deposit sales tax for rental activity taking place in Pinellas County, which is subject to the reduced 3.0% (June 1, 2024) sales tax rate and the previous 5.5% (December 1, 2023) sales tax rate.

However, this reduction does not change the sales tax rate for all other taxable sales. All other sales tax activity (not rental related) should be posted to one of the following general ledger accounts.

Account number 311315 (Sales Tax Liab MD NOT Rental) – this account is used to record/deposit sales tax for goods or services being sold in Miami-Dade County which are subject to the 7.0% sales tax rate.

Account number 311317 (Sales Tax Liab BWD NOT Rental) – this account is used to record/deposit sales tax for goods or services being sold in Broward County which are subject to the 7.0% sales tax rate.

Please continue to use Department Number 110401000 and Activity Number 1104120007 for all sales tax deposits regardless of the general ledger account used.

If you have questions about this change or any other sales tax questions, please email Tax Compliance Services or call any of the Tax Compliance team members. You can also click this link to Florida Tax Information Publication (TIP) No. 24A01-02, which contains additional information related to the sales tax rate change.

Reminders & Deadlines

Departmental Card Deadline

As a reminder, Departmental Card billing transactions regularly load the first business day of the month; program participants will have 10 days to process this activity in its entirety. This month’s billing statement (dated 03/31/2024) loaded into PantherSoft on April 1st and must be completely processed by the end of business April 12, 2024.

Any charges not processed by the closing deadline will be automatically charged to the cardholder’s default accounting on file and will not be eligible for expense transfer. Additionally, cardholders with three unjustified non-approvals in the same fiscal year may have their card limits temporarily suspended until they complete a retraining session.

Pending Travel Reports

Please approve Travel Authorizations, Cash Advances, and Expense reports in a timely manner. Documents that have not been completely finalized and are older than 90 days will be canceled or deleted by the Travel Department. A list of pending documents is located here. For information regarding report status abbreviations and how to close or cancel Travel Authorizations and/or Expense Reports, please click here.

Unidentified Wire Transfers and ACH Payments

The Controller’s Office occasionally receives payments that cannot be applied to the appropriate department due to inadequate information. Click here for the list of unidentified wire transfers and ACH payments as of March 2024.

To claim a payment, please contact Cash Management and provide the following information:

- Payment details

- Activity/Speedtype to which the payment should be recorded

- Revenue Account to which the payment should be recorded

Payments that are not identified within 45 days of the wire/ACH date will be returned to sender.

Surplus Form Submission Requirements

Effective immediately, the University has implemented changes to the Surplus Form submission requirements. The most significant change is that pictures must be attached to the email sent to property@fiu.edu of the equipment that is listed on the Surplus Form.

The Surplus Form has been updated with specific instructions on page 2 of the form.

Please take a few minutes to review the form located at: https://controller.fiu.edu/wp-content/uploads/sites/24/2020/08/SurplusForm.pdf

Should you need additional information or have any questions, please contact Property Control at: property@fiu.edu or (305) 348-2167.

For additional information, please visit Asset Management’s website: https://controller.fiu.edu/departments/accounting-reporting/asset-management/