Newsletter 2023-2024 Volume 4

In this edition…

- Monthly Closing Deadlines

- Help Us Help You corner

- Auxiliary & Enterprise Development

- Surplus Property Microsoft TEAMS Account

- Surplus Form Submission Requirements

- Smart Journal Enhancements

- NEW PCard Reconciliation Functionalities are Coming Soon

- Unrelated Business Income Tax (UBIT) – IRS Form 990-T

- Florida Sales Tax Rate

- Travel News

- Travel Module Updates

- Travel Authorization Workflow

- Expense Report Workflow

- Limiting Allowable Hotel Expenses Continues for FY-2024

- Reminders and Deadlines

News

Monthly Closing Deadlines

The September 2023 period in the general ledger has closed. The current and future month-end processing deadline schedules are located at Monthly Closing Deadlines.

Help Us Help You corner

As mentioned during the Finance Managers meeting, we have added a feature to the Office of the Controller website to facilitate and encourage feedback from all users on accounting topics and issues, questions, suggestions for business process improvements, etc. This feature is called “Help Us Help You” and it provides a link to send messages and comments that will be reviewed by the Controller and her respective team so that your ideas, questions, suggestions and any other feedback shared will be communicated and can be more easily highlighted for prompt follow up to better assist you. The Controller’s office is here to support you, your teams and your operations, therefore your feedback is critical to enable us to continue enhancing our customer service. We encourage you all to take advantage of this new feature and “Help Us Help You”

Auxiliary & Enterprise Development

The Office of Auxiliary & Enterprise Development is pleased to announce the newly revised Auxiliary Operating Guidelines. Workshops to discuss the new guidelines are scheduled during the week of October 16 to ensure all your questions are answered.

Click the flyer to register for a workshop today!

Surplus Property Microsoft TEAMS Account

The University Surplus Property warehouse is responsible for the receipt, handling and disposal of certified University Surplus Property in compliance with Florida State Statute Ch.375.055 and FIU Property Control Manual.

To raise awareness about re-purposing surplus property within our university, our team implemented the use of “Microsoft Teams” as a hub for all communication related with Surplus Property. To become a member of our team please click here. Or go to your Microsoft Teams account>Teams. Click on Join or Create a Team and search for Surplus Property>click on Join Team.

Surplus assets are made available to the departments at no cost, on a first come, first serve basis.

For additional information, please visit Asset Management’s website:

https://controller.fiu.edu/departments/accounting-reporting/asset-management/

Surplus Warehouse Contact Information: surplus@fiu.edu or 305-348-2799

Surplus Form Submission Requirements

Effective immediately, the University has implemented changes to the Surplus Form submission requirements. The most significant change is that pictures must be attached to the email sent to property@fiu.edu of the equipment that is listed on the Surplus Form.

The Surplus Form has been updated with specific instructions on page 2 of the form.

Please take a few minutes to review the form located at: https://controller.fiu.edu/wp-content/uploads/sites/24/2020/08/SurplusForm.pdf

Should you need additional information or have any questions, please contact Property Control at: property@fiu.edu or (305) 348-2167.

For additional information, please visit Asset Management’s website: https://controller.fiu.edu/departments/accounting-reporting/asset-management/

Smart Journal Enhancements

FIU Community, as part of our continuous efforts to enhance current processes related to cash transfers using the Smart Journal tool, Departments are now able to process cash transfers between ORED funds 653, 654 and 655 using GL accounts available in the Smart Journal System.

This eliminates the need to prepare paper based cash transfers.

Cash Transfer Requests for Construction Projects coordinated by Facilities Management must use GL Accounts 757005 and 657005. Initiators should contact Facilities Management to confirm the appropriate project numbers to be used when creating the cash transfer.

For guidance, please see the Smart Journal Entry Manual.

For Training Resources (Smart Journal) please visit:

NEW PCard Reconciliation Functionalities are Coming Soon

We are excited to announce upcoming enhancements to the Reconcile PCard Statement pages in PantherSoft Financials.

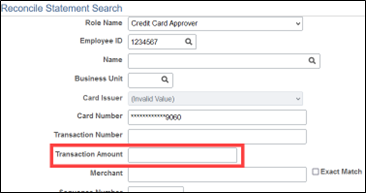

Reconcile Statement Search

To help PCard program participants locate specific charges more efficiently, a new Transaction Amount field will be added to the Reconciliation Statement Search page.

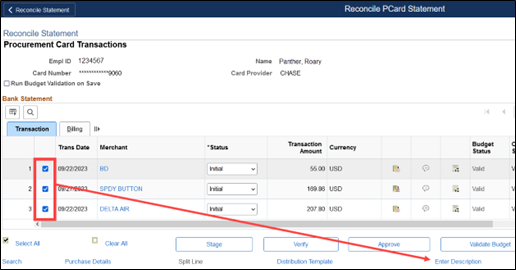

Reconcile PCard Statement

Reconciliation of PCard charges can often be a tedious and time-consuming process. To facilitate this task, we are also implementing a new functionality that allows you to select multiple lines that share the same description and update them all at once. Once the lines are selected, cardholders and reconcilers can click the Enter Description link at the bottom of the page. They will enter the description on the next page, click OK and the description will appear for the selected lines in the Billing tab.

Unrelated Business Income Tax (UBIT) – IRS Form 990-T

Florida International University is required by Federal law to prepare an income tax return for net income from activities unrelated to the exempt mission of the University. This tax return (Form 990-T) must be filed annually with the Internal Revenue Service (IRS).

The IRS has provided the following criteria to identify activities that are unrelated to the mission of an exempt organization. An activity is an unrelated business (and subject to unrelated business income tax “UBIT”) if it meets three requirements: (1) It is a “trade or business”; (2) It is “regularly carried on”; and (3) It is “not substantially related” to furthering FIU’s exempt purpose. Since these terms are given a specific meaning within the rules set forth by the IRS and several important exceptions exist, guidelines for these criteria are available from the Tax Compliance office for your review.

The Tax Compliance office has begun gathering the data for the fiscal year ended June 30, 2023, and cannot identify all activities that are unrelated and subject to Federal income tax from the accounting records alone. Therefore, we are asking that all Departments review their operations for the 2022-2023 fiscal-year and determine what activities, if any, are potentially unrelated business income. Please keep in mind that Florida International University must account for and report all unrelated business income pursuant to the Internal Revenue Code.

Some departments may have received lost revenue reimbursements, from the Higher Education Emergency Relief Funds (HEERF), for the fiscal year ended June 30, 2023. Do not report this revenue as UBI even when the reimbursement was for lost revenue that would normally be treated as UBI. The lost revenue reimbursement is Federal Aid and not subject to UBI.

Please note that due to recent changes in the tax law, departments that conduct multiple unrelated activities, (rentals, advertising income, admission fee income, etc.) must complete a separate UBIT questionnaire and UBIT income statement for each activity. Do not combine multiple activities into a single questionnaire and income statement.

A reminder email has been sent to those Department Heads & Finance Managers with UBIT activity in prior years, with links to the UBIT questionnaire and additional UBIT information. If you did not receive the email and have UBI to report or want additional guidance, the information is also available on the Controller’s website at the following link: https://controller.fiu.edu/departments/accounting-reporting/tax-compliance-payroll/unrelated/

If your department does not generate Unrelated Business Income (UBI) and only conducts educational activities, you do not need to return the UBI Questionnaire. If you have questions about unrelated business income or are conducting a revenue generating activity, and are unsure if reporting is required, please contact tax@fiu.edu or call (305) 348-2655 for more information.

Please submit your UBI information as soon as possible.

Florida Sales Tax

Florida Sales Tax Rate Decreased to 4.5% on December 1, 2023, for Rental, Lease, or License to Use Real Property

Currently, Florida imposes a 6% sales tax on the sales of most goods and certain services. In addition, Florida counties can impose a local option surtax on top of the 6% rate that varies by county. Therefore, the sales tax rate is 7% in Miami-Dade County, Broward County, and Pinellas County (due to the additional 1% surtax).

The sales tax is also imposed on commercial leases and licenses to use real property, but at a reduced rate. Some examples of real property rentals that are subject to tax include (commercial office or retail space, conference rooms, ballrooms, stadiums, arenas, etc.). The sales tax rate imposed under Florida Statutes on the rent charged for renting, leasing, or granting a license to use real property is currently 6.5% (5.5% plus the additional 1% surtax).

Effective December 1, 2023, the sales tax rate imposed under Florida Statutes on the rent charged for renting, leasing, or granting a license to use real property is decreased to 4.5%. Therefore, the sales tax rate for any rental activity taking place on or after December 1, 2023, will be 5.5% (4.5% plus the additional 1% surtax) for Miami-Dade County, Broward County, and Pinellas County.

To accurately collect and remit the sales tax collected by the University, rental related sales tax collections should only be posted to one of the following general ledger accounts shown below.

Account number 311318 (Sales Tax Liab MD Prop Rental) – this account is used to record/deposit sales tax for rental activity taking place in Miami-Dade County, that is subject to the reduced 5.5% (2023) sales tax rate and previous 6.5% (2020) sales tax rate.

Account number 311319 (Sales Tax Liab Bwd Prop Rental) – this account is used to record/deposit sales tax for rental activity taking place in Broward County, that is subject to the reduced 5.5% (2023) sales tax rate and previous 6.5% (2020) sales tax rate.

Account number 311320 (Sales Tax Liab PIN Prop Rental) – this account is used to record/deposit sales tax for rental activity taking place in Pinellas County, that is subject to the reduced 5.5% (2023) sales tax rate and previous (2020) sales tax rate.

However, this reduction does not change the sales tax rate for all other taxable sales. All other sales tax activity (not rental related) should be posted to one of the following general ledger accounts.

Account number 311315 (Sales Tax Liab MD NOT Rental) – this account is used to record/deposit sales tax for goods or services being sold in Miami-Dade County which are subject to the 7.0% sales tax rate.

Account number 311317 (Sales Tax Liab BWD NOT Rental) – this account is used to record/deposit sales tax for goods or services being sold in Broward County which are subject to the 7.0% sales tax rate.

Please continue to use Department Number 110401000 and Activity Number 1104120007 for all sales tax deposit regardless of general ledger account used.

If you have questions about this change or any other sales tax questions, please email Tax Compliance Services or call any of the Tax Compliance team members. You can also click this link to Florida Tax Information Publication (TIP) No. 23A01-20, which contains additional information related to the sales tax rate change.

Travel News

- Travel Proxies and HR Supervisors, Expense Managers, Project Managers, or Supplemental Approver must ensure Travel Authorizations, Cash Advances, and Expense Reports are being submitted properly and in a timely matter in accordance with FIU Travel Policy and Florida Statute (FS) 112.061.

- The Expense Report must be signed by the employee whose name appears at the top of the document via DocuSign or the “Print and Sign” option.

- Ensure all receipts and supporting documentation are legible and uploaded prior to submitting an expense report to avoid delay in reimbursements.

- All documents should be scanned into a single PDF file rather than individually.

- The location of pick-up and drop-off must be annotated on the receipt for Taxi, Uber, Lyft, or shuttle (i.e., home to the airport, airport to the hotel, etc.)

- If a University credit card or purchase order was used to pay for expenses, it must be annotated on the receipts prior to submitting the expense report.

- Vicinity travel will not be reimbursed if the dates claimed are over ninety (90) days old.

- The University’s procurement system must be utilized to the fullest extent for the operation of FIU. The Purchasing Services and the Credit Card Solutions department serve as the solution for acquiring equipment, furnishings, supplies, food, travel, renting meeting rooms, etc.

Travel Module Updates

The Travel and Expense module is now the T&E Compliance Center. The new name indicates the merging of the financial workflow with pre- and post-trip compliance screening and the State of Florida and federal reporting requirements.

Travel Authorization Workflow

It has been enhanced with specific information and a seamless screening process before departure to assist international travelers with protecting themselves and the institution from foreign influence threats and being well prepared and safe while abroad.

Expense Report Workflow

It has been modified for the traveler to include information that must be reported to the State of Florida annually. As a reminder, all employees (including student employees) must complete the TA and the ER/Post-Trip Compliance report for international trips, regardless of the funding source. Students not employed must complete the pre-departure registration and orientation through the Office of Education Abroad (contact edabroad@fiu.edu); should FIU be funding the trip, they also need a TA and ER/Post-Trip Compliance report to first encumber and eventually disburse these funds.

Limiting Allowable Hotel Expenses Continues for FY-2024

For the current fiscal year, the Florida Legislature has mandated in HB 5003 that lodging paid with state funding may not exceed $225 per night for university employees for events (meetings, conferences, or conventions) sponsored or organized in whole or in part by Florida International University. State funds include all E&G funds and state-sponsored grants. Amounts exceeding $225 per night may be paid through an alternative funding source.

Departments must ensure this law’s requirements are met when lodging for FIU employees attending FIU-sponsored events.

Reminders & Deadlines

Monthly Departmental Card Deadline

As a reminder, Departmental Card billing transactions regularly load the first business day of the month; program participants will have 10 days to process this activity in its entirety. This month’s billing statement (dated 9/29/2023) loaded into PantherSoft on October 2nd and must be completely processed by the end of business on October 13, 2023.

Any charges not processed by the closing deadline will be automatically charged to the cardholder’s default accounting on file and will not be eligible for expense transfer.

Additionally, cardholders with three unjustified non-approvals in the same fiscal year will have their card limits suspended until they complete a retraining session.

Pending Travel Reports

Please approve Travel Authorizations, Cash Advances, and Expense reports in a timely manner. For a list of pending documents, please click here. For information regarding report status abbreviations and how to close or cancel Travel Authorizations and/or Expense Reports, please click here.